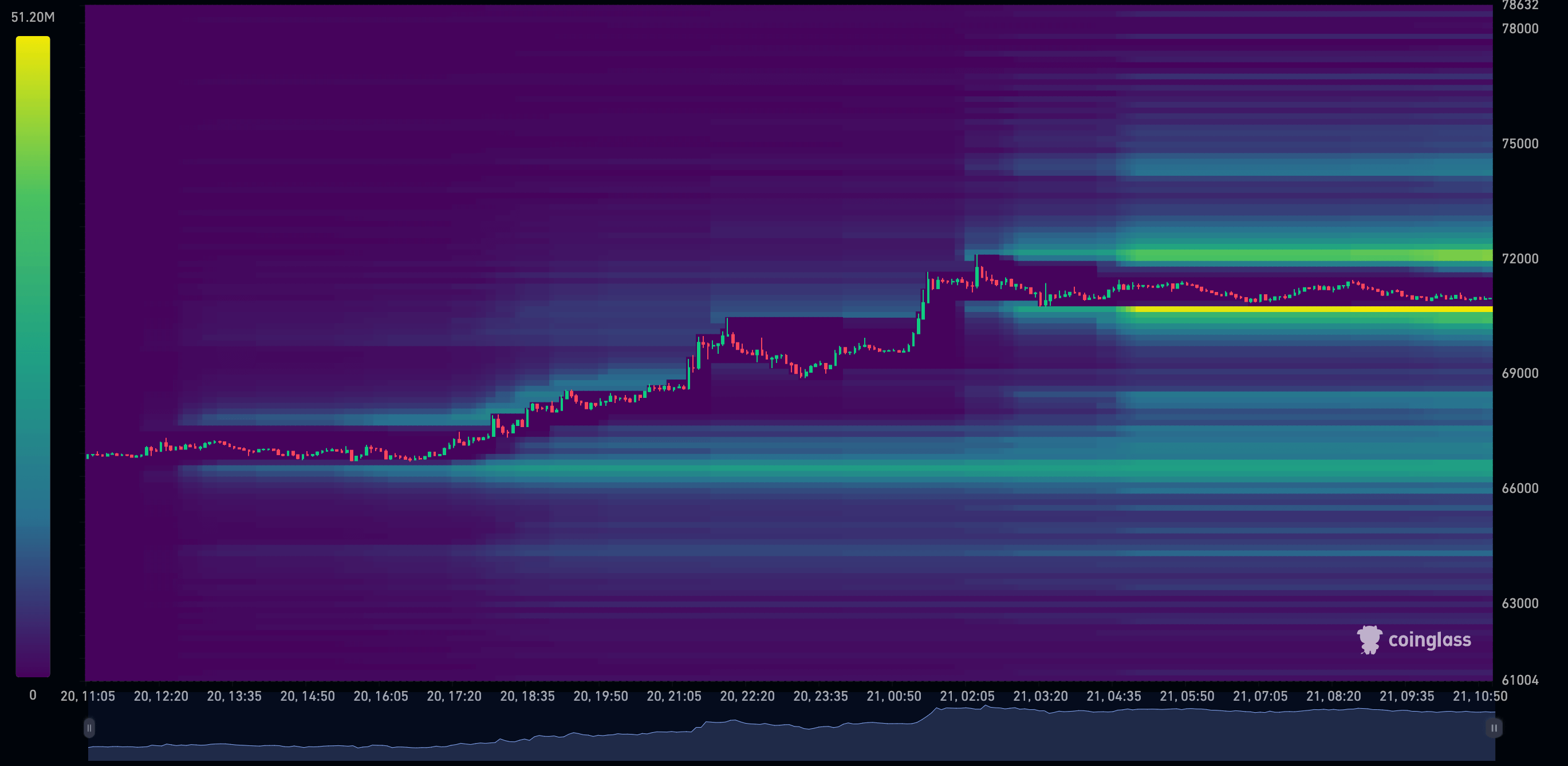

Bitcoin Liquidation Heatmap

In the world of cryptocurrencies, liquidations play a crucial role, especially during periods of high volatility. Understanding and monitoring liquidations can provide traders with valuable insights into current market conditions and potential entry and exit points. One of the most effective tools for this is the liquidation heatmap.

What is a Cryptocurrency Liquidation Heatmap?

A cryptocurrency liquidation heatmap predicts the price levels at which large-scale liquidation events may occur. A liquidation event happens when a trader's positions are closed due to price fluctuations and their margin account balance is insufficient to cover the open positions. To prevent further losses for both traders and exchanges, most exchanges offer a liquidation level, which is the price at which leveraged trades will be forcibly closed.

Traders who can estimate the liquidation levels of other traders may gain an advantage similar to understanding high liquidity in the order book. The liquidation heatmap, such as the one provided by Coinglass, attempts to predict where significant liquidations may occur to help traders find the best liquidity positions.

Benefits of Using a Liquidation Heatmap

- Market Sentiment Identification: The heatmap allows traders to see where major liquidation levels are, helping to understand market sentiment. For example, a large number of long liquidations may indicate bearish sentiment.

- Key Level Identification: The heatmap helps determine levels where the most liquidations occur, which often correspond to important support and resistance levels.

- Precise Entry and Exit Timing: Analyzing liquidations allows traders to more accurately determine moments for entering and exiting trades, minimizing risks and maximizing profits.

- Volatility Analysis: The heatmap highlights areas with high volatility where mass liquidations occur, signaling traders to exercise increased caution.

How the Bitcoin Liquidation Heatmap Works

The Bitcoin liquidation heatmap calculates the liquidation levels based on market data and different leverage amounts. The calculated levels are then added to the prices on the chart. As more estimated liquidation levels are added to a particular price, the colors on the heatmap change. The color range goes from purple to yellow, with yellow representing a high number of predicted liquidation levels, allowing traders to identify areas of high liquidity.

The heatmap predicts where liquidation levels are likely to initiate but not where they will stop. Therefore, the actual number of liquidations will be fewer. When considering the size, it must be viewed as a relative figure by comparing it with other levels. Users can filter multiple major exchanges, trading pairs, and historical liquidation data.

Using the Liquidation Heatmap in Trading

The liquidation heatmap allows traders to identify areas of high liquidity, which can be helpful in various ways:

- Magnet Zone: Concentration of potential liquidation levels within a specific price range may indicate that the price is likely to move towards that zone. Some traders utilize these liquidation levels to gauge the possible direction of price movement and as additional indicators for convergence.

- Support/Resistance Zone: In high liquidation areas, larger traders or "whales" can execute trades rapidly at favorable prices. Once they enter or exit orders within this liquidity, the price can now reverse.

- Pressure on Order Book: Liquidation levels can exert significant pressure on either the buy or sell side of the order book, leading to a natural price reversal.

Conclusion

A cryptocurrency liquidation heatmap, particularly for Bitcoin, is a powerful tool for market analysis. It helps traders understand where key liquidation levels are and use this information to make more informed trading decisions. In a market as volatile and unpredictable as cryptocurrency, using analytical tools like a liquidation heatmap can significantly increase the chances of successful trading.Understanding the mechanics of liquidations and being able to read a Bitcoin liquidation heatmap gives traders a crucial competitive edge, allowing them to better gauge market sentiment and make decisions based on real data. Use the liquidation heatmap to enhance the effectiveness of your trading strategy and reach new heights in the world of crypto trading.