In the cryptocurrency market, "long" and "short" strategies are fundamental tools for traders looking to profit from both rising and falling asset prices. Binance offers extensive opportunities for utilizing these strategies. In this article, we will explore what long and short positions are on Binance, how the long/short ratio works, and how traders can use these strategies to maximize profits.

What are Long and Short Positions?

Before delving into the specifics of using long and short positions on Binance, it's important to understand the basic concepts.

Long

A long position is a strategy where a trader buys an asset with the expectation that its price will rise in the future. The main idea is to buy low and sell high, profiting from the price difference. This is the most common strategy among investors and traders when the market is in an upward trend.

Short

A short position is a strategy where a trader borrows an asset and sells it with the expectation that its price will fall. The trader then buys the asset back at a lower price, returns it to the lender, and profits from the difference. This strategy is used to profit from a declining market and can be more risky than a long position due to the potential for unlimited losses.

Long/Short Ratio on Binance

What is the Long/Short Ratio?

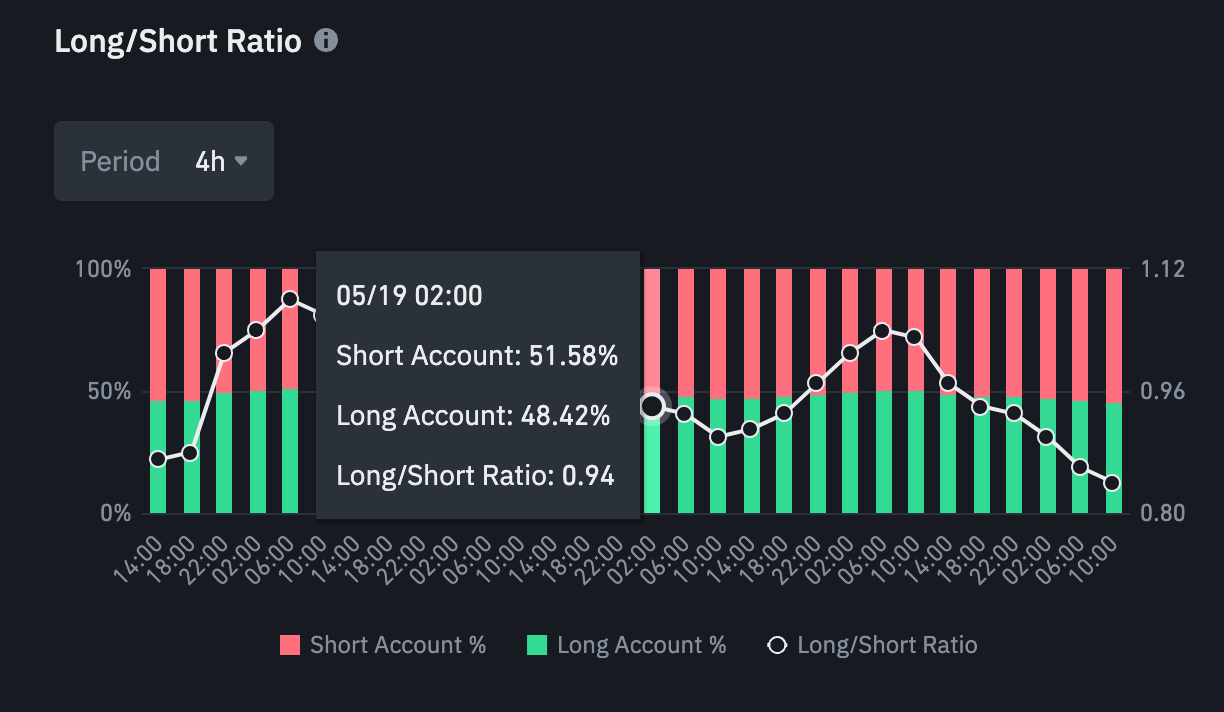

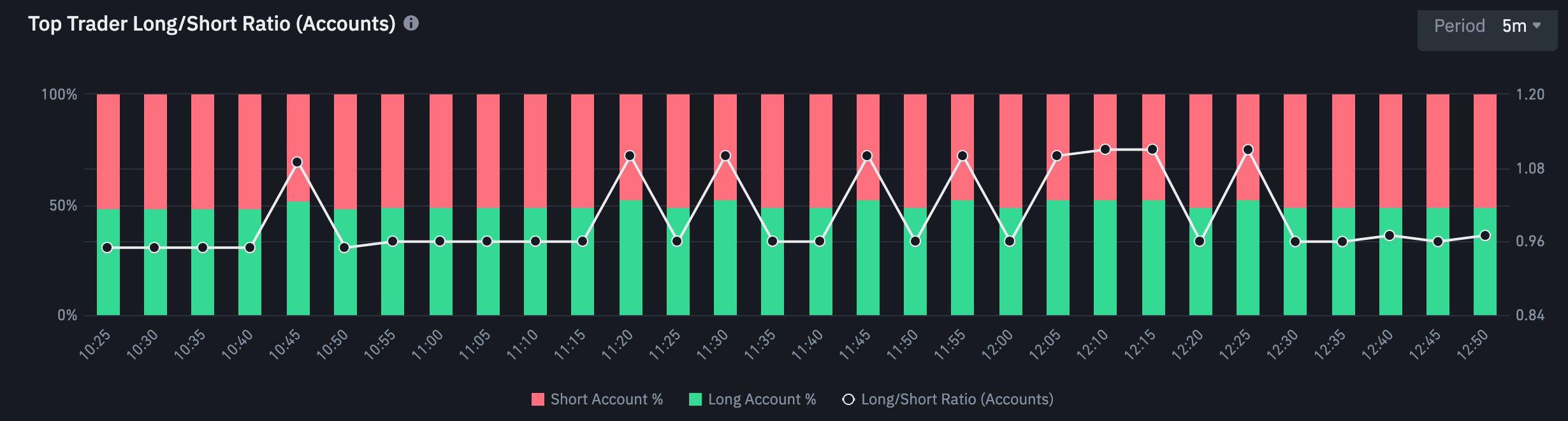

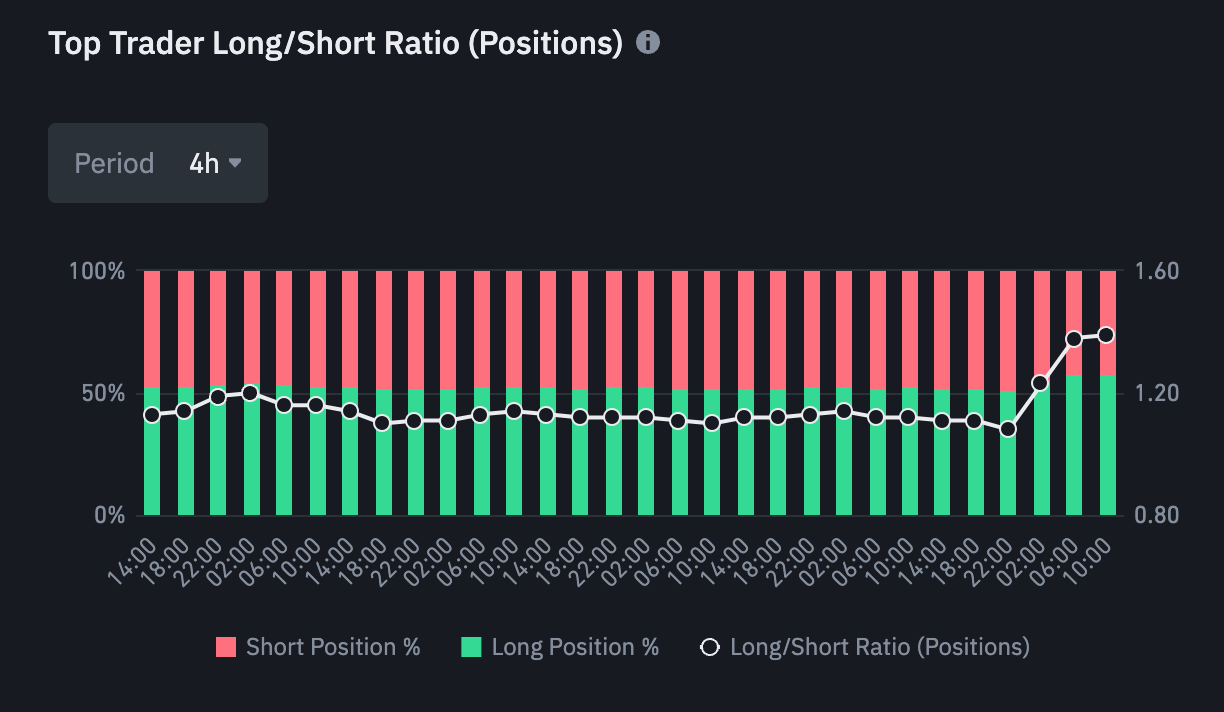

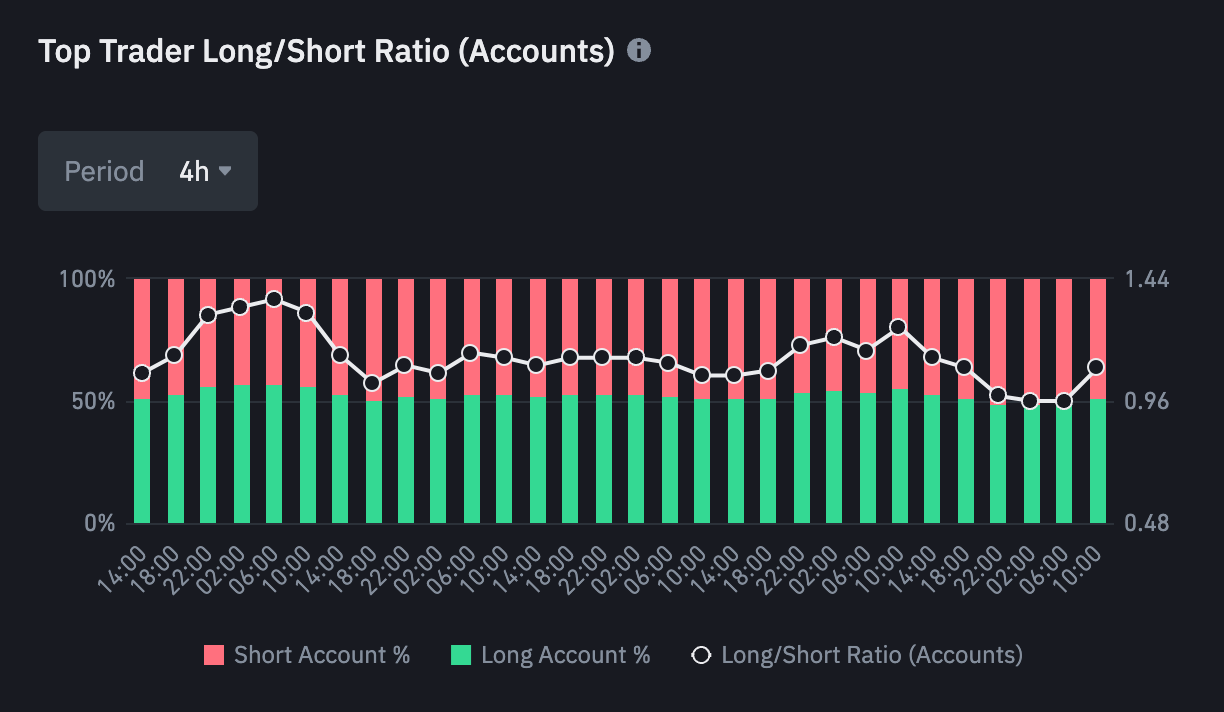

The long/short ratio is an indicator that reflects the ratio of open long positions to open short positions in the market. It is used to gauge market sentiment and determine possible price movements.

How to Use the Long/Short Ratio on Binance?

On the Binance platform, traders can monitor the long/short ratio for various cryptocurrency pairs. This indicator can help traders make more informed decisions when opening positions.

Usage Examples:

- Market Sentiment Analysis: A high long/short ratio indicates that most traders expect the asset's price to rise. This could be a signal to open a long position. Conversely, a low ratio suggests that traders expect the price to fall, signaling a potential short position.

- Risk Assessment: Traders can use the long/short ratio to assess risk. If the ratio is heavily skewed in one direction, it may indicate the possibility of a sharp price movement in the opposite direction when traders start to close their positions en masse.

Simultaneous Long and Short on Binance

Sometimes traders use a strategy of opening both long and short positions simultaneously. This strategy, known as hedging, helps reduce risks and protect the portfolio from significant market fluctuations.

Advantages and Disadvantages of Hedging

Advantages:

- Risk Reduction: Hedging helps minimize risks associated with sharp price changes in the market.

- Profit Stability: Traders can profit from both rising and falling prices, ensuring a stable income.

Disadvantages:

- Management Complexity: Managing both long and short positions simultaneously requires high analytical skills and constant market monitoring.

- Additional Costs: Hedging can involve additional transaction costs and fees, reducing overall profitability.

Long/Short Ratio on Binance

How to Monitor the Long/Short Ratio?

Binance provides tools for monitoring the long/short ratio. This allows traders to respond quickly to changes in market sentiment and adjust their strategies.

Useful Tools:

- Interactive Charts: Binance provides access to interactive charts that display the long/short ratio in real-time. This allows traders to quickly assess market sentiment.

- Analytical Reports: Weekly and monthly analytical reports from Binance include data on the long/short ratio and other key metrics, helping traders make informed decisions.

How to Use the Long/Short Ratio in Trading?

Trading Strategies:

- Trend Following: If the long/short ratio indicates a predominance of long positions, traders might open long positions, following the trend. Conversely, when short positions predominate, opening short positions might be wise.

- Contrarian Trading: Some traders prefer to open opposite positions when the long/short ratio reaches extreme values, betting on a trend reversal.

- Liquidity Analysis: A high long/short ratio can indicate high liquidity and the possibility of large price movements, allowing traders to plan their trades considering potential risks and profits.

Conclusion

Long and short strategies are foundational for successful trading in cryptocurrency markets. Binance offers a wide range of tools to implement these strategies, including the long/short ratio and hedging options. Understanding and utilizing these tools can significantly enhance trading efficiency and help traders achieve their financial goals.

To maximize success, it is crucial not only to use available tools but also to continually improve your knowledge and skills. Binance offers educational resources and analytical reports to help traders stay up-to-date with the latest trends and enhance their trading strategies.

Looking to enhance your knowledge and skills in cryptocurrency trading? Our Daytrading Futures course offers comprehensive training, practical sessions, and support from experienced traders to help you succeed in the world of futures trading. Visit our education page to learn more and start your journey to financial independence today!